From the past few years, it is undeniable that the connection of supply chains around the world is totally connected which is advantageous in all fields of business that require the transportation of goods. However, there are some signals showing that the global supply chain may be changed soon.

In March 2022, the world was in trouble when the Evergreen vessel struck in Suez Canal for almost a week. Almost 170 ships could not pass the canal, and transportation by sea across the region was totally disrupted which affected the whole global supply chain.

Combined with the uncertainty of the current situation such as energy shortages, geopolitical uncertainty, or extreme climate change, the transportation of goods across the country should be diversified to deal with unexpected problems.

As above mentioned, the alternative way for diversifying of good transportation is selecting modes of transport. Air freight is one of the interesting options for transporting goods across countries. Time and safety are major factors that customers consider for transporting goods, which are the strengths and potential of air freight for attaching the customers for choosing air freight instead of other modes.

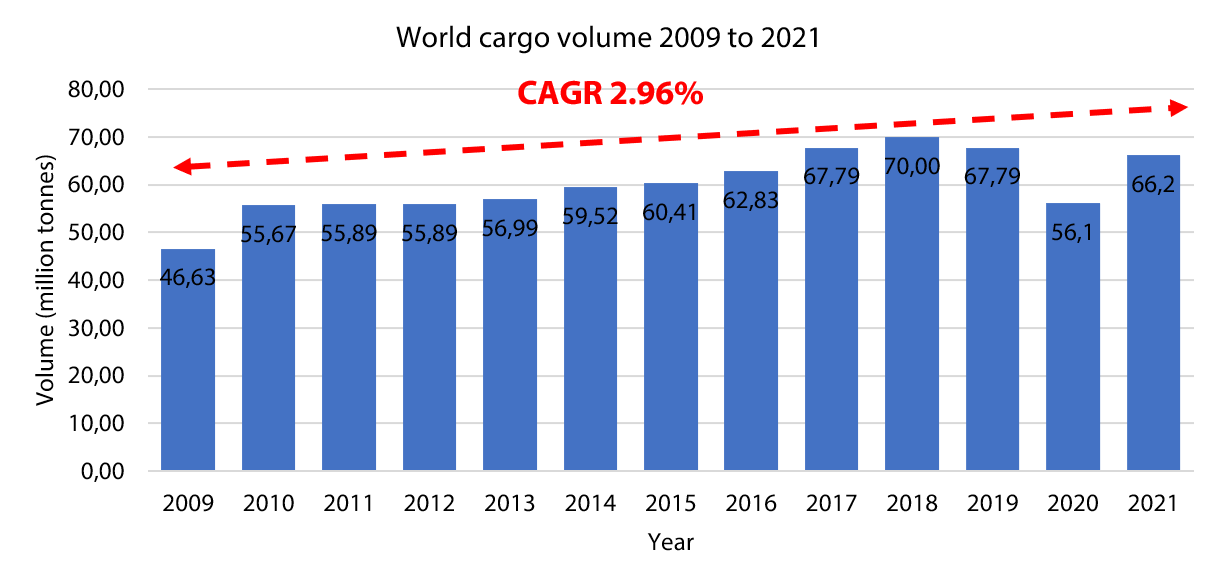

Looking at the world trend from Figure 1 (IATA,2021), the volume of world cargo was growing each year until 2018. Then, the world faced the COVID-19 pandemic which affected all sectors of the aviation business. The world air cargo volume in 2019 and 2020 dropped. However, the world trend of air cargo volume rebounded in 2021, thanks to the technology that helps us quickly recover from the pandemic and also the e-commerce market that comforts trading between countries which is the factor that supports the air cargo business to not extremely drop during the pandemic. The graph shows that air cargo is still in a positive trend with a CAGR account of 2.96%

Moreover, Asia-Pacific has the highest market share in 2021 at 32.4% accounting for 21.45 million tonnes of world cargo volume. It is sure that there are some interesting countries in Asia-Pacific that have the potential in the air cargo business.

In the 21st Century, it is expected that the business of countries in the Asia Pacific will grow in all sectors and become an interesting choice for investors. This may be caused by the lower cost of production in the Asia Pacific, especially in Southeast Asia (SEA) when compared to other regions. The average labour cost in SEA is around 5.85 US dollars per day while in China is around 8.08. Moreover, SEA is also full of environmental resources, energy resources, and human resources which are attractive points for investors to choose SEA for investing in the manufacturing hub.

This will be an advantage for all countries in SEA to enhance all sectors of business and the transportation of goods will become a major key driver in businesses.

Thailand is also one of the famous destinations for various investors investing in manufacturing houses. According to the Department of Trade Negotiation of Thailand, the major products exported from Thailand are electronic components, automobile components, and electronic devices are the top 3 products exported for Thailand accounting for 11,103, 10,120, and 9,356 million USD respectively.

Moreover, Thailand is a top player in the global agricultural industry. The value of agricultural products exported from Thailand is approximately 6,267 million USD, which is listed in the first rank in SEA and 8th rank in the world. This will advantage the air cargo business in Thailand for distributing the cargo out from Thailand.

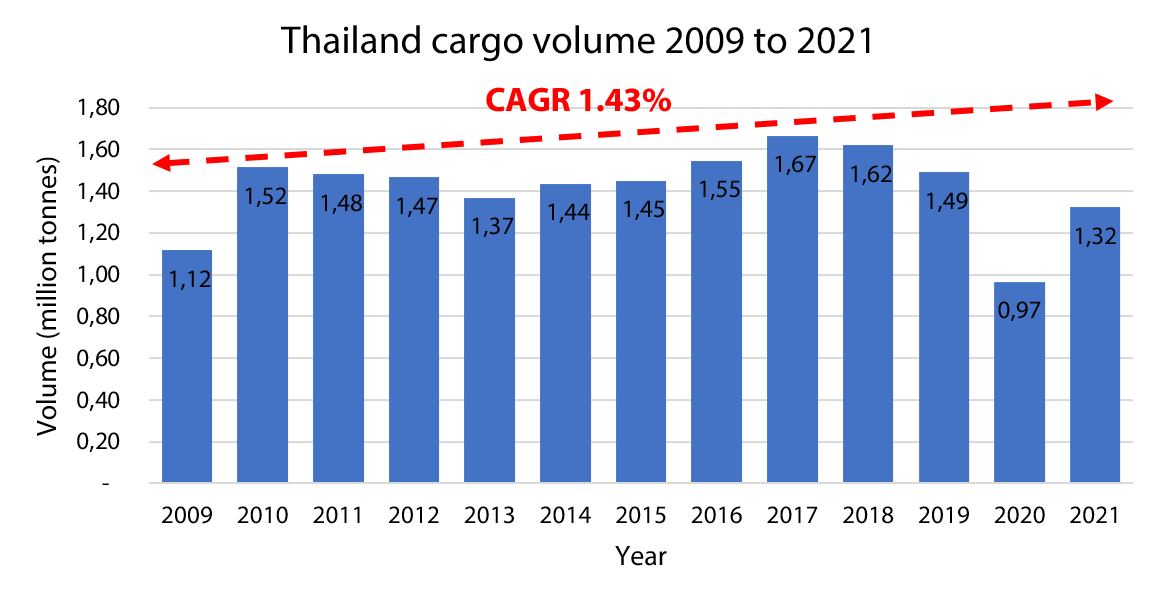

The total cargo volume in Thailand is shown in Figure 2 (CAAT,2020-2021). It can be seen that the trend of air cargo in Thailand is related to the world trend in Figure 1. The overall air cargo business in Thailand was also in a positive trend with a CAGR of 1.43%, from 2009 to 2021. In 2021, Thailand can capture the market share of air cargo in the Asia Pacific approximately by 6.17%.

Compared to the key player in SEA, Singapore which is the direct competitor in the air cargo business in Thailand, can handle around 2.15 million tonnes of cargo in 2021, accounting for 10.02% of the total volume in Asia Pacific. Singapore is a famous destination where various countries distribute their cargo to them. Therefore, this comes with the question that why most countries choose Singapore as a cargo hub but not Thailand for distributing their cargo.

For Singapore, the air cargo hub at Changi International airport has more than 900 cargo flights weekly and connects to over 90 cargo hubs around the world.

The hub has facilities for supporting the customers such as a temperature control facility, an e-Commerce hub, and a hub for the major players such as DHL, FedEx, and UPS. Most facilities are a fully automated system for handling the cargo which can minimise the handling time in the hub.

Singapore cargo hub also transforms itself with digitalisation to connect all sectors in air cargo together. This is advantageous for reducing the handling time and enhancing the precision of cargo handling.

The geography of the Singapore hub is advantageous to itself to switch the transportation mode. It takes less than 1 hour to ship the cargo from Changi International Airport to the seaport in Singapore. This is a strong point that makes Singapore to be the cargo hub not only via air but also via sea.

Moreover, the Singapore hub also has a free trade zone where most airlines choose to drop their transshipment cargos which helps the Singapore hub to become one of the hubs that have the busiest movement of transit cargo in the world.

It can be seen that there are some points that Singapore is leading Thailand in terms of being the most famous air cargo hub in SEA.

To become the air cargo hub in SEA, Thailand needs to face some challenges and needs some improvements to enhance the efficiency of the air cargo business.

How can it become a reality?

Firstly, the integration of technology in all sectors will increase the efficiency of the air cargo business in Thailand. The automated system integrated into the air cargo terminal will shorten handling time and maximise the utilisation of resources. Management software also requires improving the management system of air cargo in Thailand which enhances the efficiency and reliability of cargo handling of the hub in Thailand,

Secondly, the connection of transportation modes also affects the opportunity for air cargo in Thailand. Although Thailand has various modes of transportation, the connection time of each mode should be minimized to increase efficiency and utilisation. The extensive network coverage of cross-border roads and high-speed railways connecting SEA with other continents can create both advantages and disadvantages for Thailand. The advantage is Thailand can be the hub for consolidating and distributing air cargo from various destinations and distributing them into the region. However, the improvement in technology nowadays may create a threat to air cargo in Thailand, the increase in the speed of transportation by rail may become a competitor of the air carbo business due to the shortening of shipping time.

Thirdly, the expansion of the route network is also an important improvement in Thailand. The top destinations for Thailand after the COVID-19 pandemic are in East Asia, SEA, South Asia, and the Middle East. Moreover, North Asia is also an important destination, especially in China, Japan, and South Korea which are the global supply chain gateway. The route network of Thailand should cover the famous air cargo hub in the world as much as possible with the appropriate flight frequency in order to gain the cargo volume as much as possible.

Lastly, the free trade zone is also a crucial factor in enhancing the air cargo business in Thailand. At this present, the free trade zone is available at Suvarnabhumi airport, but it is not successful as expected. The limitations or constraints for effectively exercising the benefits of free trade zone should be rectified to increase the volume of transit cargo in the Thailand hub which can rising the potential of the air cargo hub in Thailand.

On a final note, it can be seen that Thailand has opportunities to become one of the leaders in the air cargo hubs in SEA since the business there has a good potential to be successful. Also still has competitive power with Singapore who is the strongest player in SEA. The world cargo demand is still rising, and Thailand should make improvements as the abovementioned to increase the potential to support the world trend and become the leader of air cargo in SEA.

Authors

Joined To70 as an aviation consultant for over 7 years since graduating with BSc in Aviation Technology Management from Kasetsart University, Thailand. He is in charge for managing projects in aviation strategy, aviation safety and aviation related software implementation.